Deferred compensation calculator

Outdated or Unsupported Browser. It not only takes into account your annual contributions projected return on investments and years until retirement but also allows you to figure.

Deferred Compensation Plan

2 taking the compensation now paying taxes on it and.

. Voya Retire App Access your retirement savings account whenever and wherever you want. Required Minimum Distribution RMD Calculator Use this calculator to determine your current RMD and estimate your. The IRS allows a total of 20500 in basic salary deferral contributions across all Workplace Savings Plans in 2022.

Once youve logged in to your account you will find even more tools that can help you. To get started log in and select Benefit Estimator Benefit Estimator Increase your savings Thinking about saving more with DCP. My Interactive Retirement Planner.

Alameda County Deferred Compensation Plan Plan Resources Quick Actions. MO Deferred Comp Roth Calculators Use these calculators to learn more about the Roth option and decide which is best for your situation pre-tax or after-tax savings. Here are some tools and calculators that may help you get a better idea about what you will need.

Calculate And Compare A Normal Taxable Investment To Two Common Tax Advantaged Situations. Go to RetiremenTrack Grow Your Retirement Savings. How much can I withdraw.

You are using an outdated or unsupported browser that will prevent you from accessing and navigating all of the features of our. The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers. Your online account offers a calculator that lets you estimate your pension benefit at retirement.

RSA-1 Deferred Compensation Plan. RetiremenTrack This calculator uses your personal information to develop a custom savings forecast that takes into consideration pension social security the deferred compensation plan and other savings. All account value information given is FOR ILLUSTRATIVE PURPOSES ONLY.

A voluntary retirement savings plan that provides quality investment options investment educational programs and related services to help State and local public employees achieve their. However your annual contribution is also subject to certain maximum total contributions per year. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

This calculator will help you determine your basic salary deferral limit which for 2022 is the lesser of 20500 or 100 of includible compensation reduced by any of the factors indicated in question 1 of the Summary Page. Not only will you defer taxes immediately but your contributions and any. This calculator helps illustrate what it might take to eventually reach your objectives.

DCP savings calculator DCP retirement planner. How long will my money last. As a supplement to other retirement benefits or savings that you may have this voluntary plan allows you to save and invest extra money for retirement tax-deferred.

A voluntary retirement savings plan that provides quality investment options investment educational programs and related services to help State and local public employees achieve their. DCP Calculator How much can I save. Investor Type What type of investor are you.

This calculator limits your contribution to 50 of your salary. The Deferred Compensation Program has these calculators available. The Retirement Income Calculator is hypothetical and for illustrative purposes only and is not intended to represent performance of any specific investment which.

The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers. Ad Compare Taxable Tax-Deferred And Tax-Free Investment Growth. The minimum loan amount available from either the 457 or the 401 k Plan is 2500.

Taking a loan from hisher Deferred Compensation Plan account can greatly impact ones future account balance. Use this calculator to help you manage withdrawals from your defined contribution accounts that you have set aside for retirement. Set up your retirement savings goals and see if you are on track to meet them.

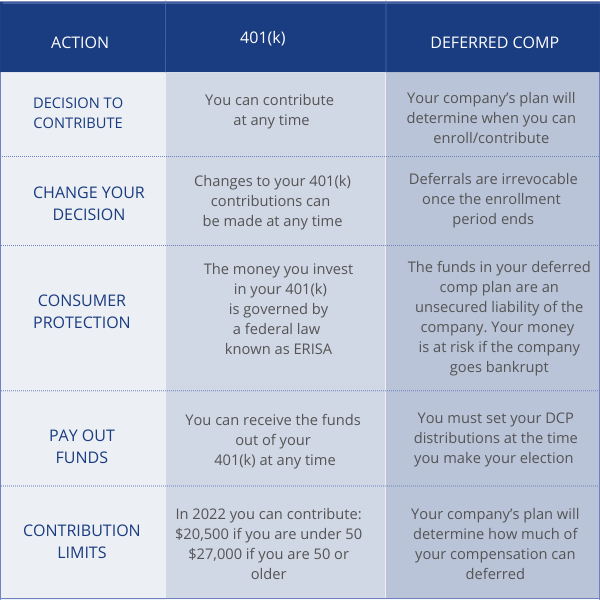

The Maximum Loan Amount a participant may obtain is the lesser of. Ad Get Access to the Largest Online Library of Legal Forms for Any State. This tool helps you determine whether youll be better off deferring your compensation or taking it now.

This 457 Savings Calculator is designed to help you make that prediction as accurately as possible. Therefore a participant should consider other ways to cover unexpected expenses. Annual contribution limits Your total contribution for one year is based on your annual salary times the percent you contribute.

1 deferring the compensation putting it into investments available to you in an NQDC account and receiving taxable distributions in the future. RSA-1 is a powerful tool to help you reach your retirement dreams. Learn what type of investment portfolio best matches your investment personality.

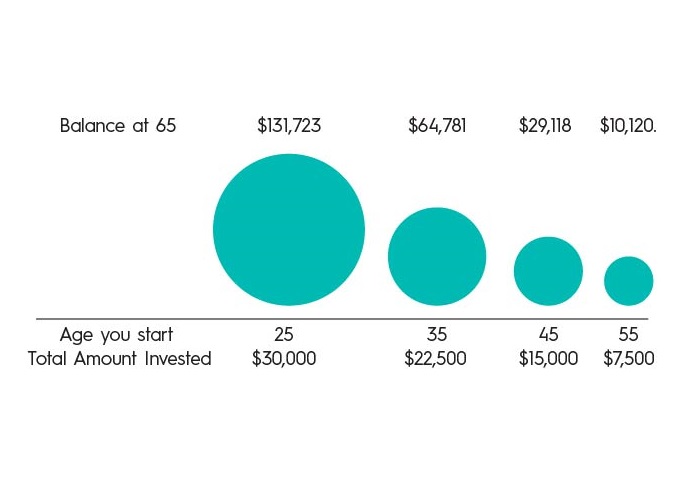

The annual maximum for 2016 is 18000. You can see the difference between. Regular Tax-Deferred Calculator Compare an after-tax Roth savings option with a traditional pre-tax retirement savings plan.

MO Deferred Comp Calculators These calculators are for informational use only. Select your monthly DCP contribution 30 to 500 550 to 1050 1100 to 2000 Important information How much can I save. Get contact information for your financial guidance professionals and plan administrators.

What You Should Know If You Have Access To A Non Qualified Deferred Compensation Plan

The Ultimate Guide To Traditional And Roth Iras For Millennials Finance Infographic Personal Finance Infographic Retirement Money

Advantages Of Being Self Employed Independent Contractor Infographic Medicaldevices Consultants Sel Medical Sales Medical Sales Rep Pharmaceutical Sales

What Is A Deferred Compensation Plan Ramseysolutions Com

Flood Projects For School Flood Insurance Flood Damage Home Insurance

Financial Ratios And The Statement Of Cash Flows Mgt537 Lecture In Hindi Urdu 24 Youtube In 2022 Financial Ratio Cash Flow Statement Cash Flow

Deferred Compensation Plan

Earned And Unearned Income For Calculating The Eic Usa Earnings Income Annuity

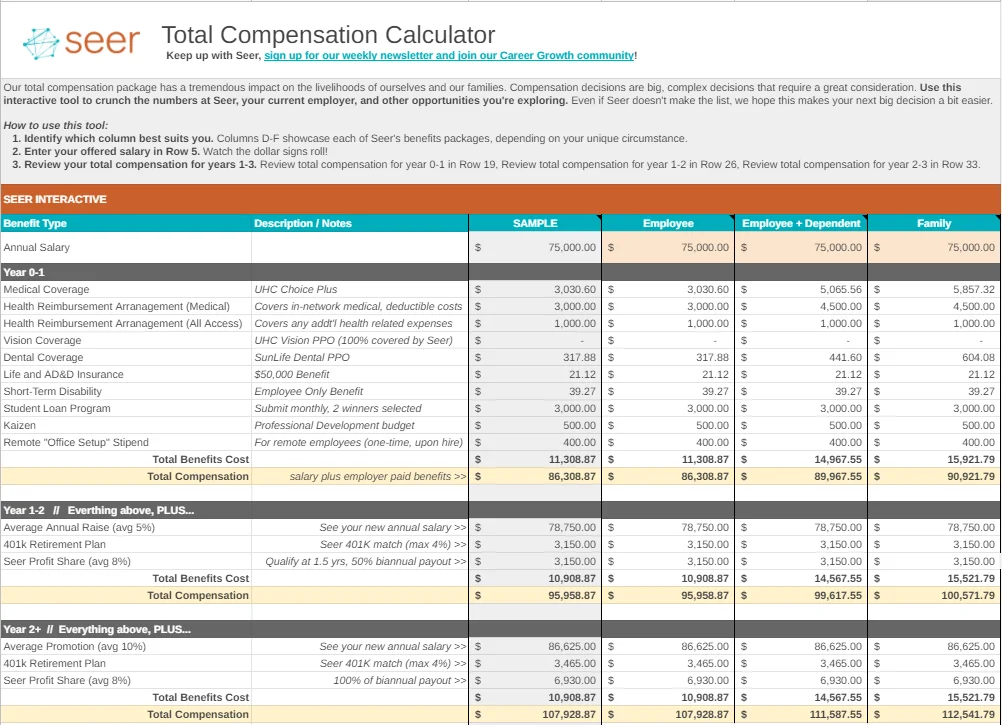

Compensation Calculator Template Examples Seer Interactive

457 Deferred Compensation Plan

Deferred Compensation Not Income For Child Support

Ibm Tdsp Calculator Ibm Calculator How To Plan

Kentucky School News And Commentary Ky Orders Review After Questions Raised About Use Of Zoom Math On Tests Math Raising School

Forwkykoxfvzrm

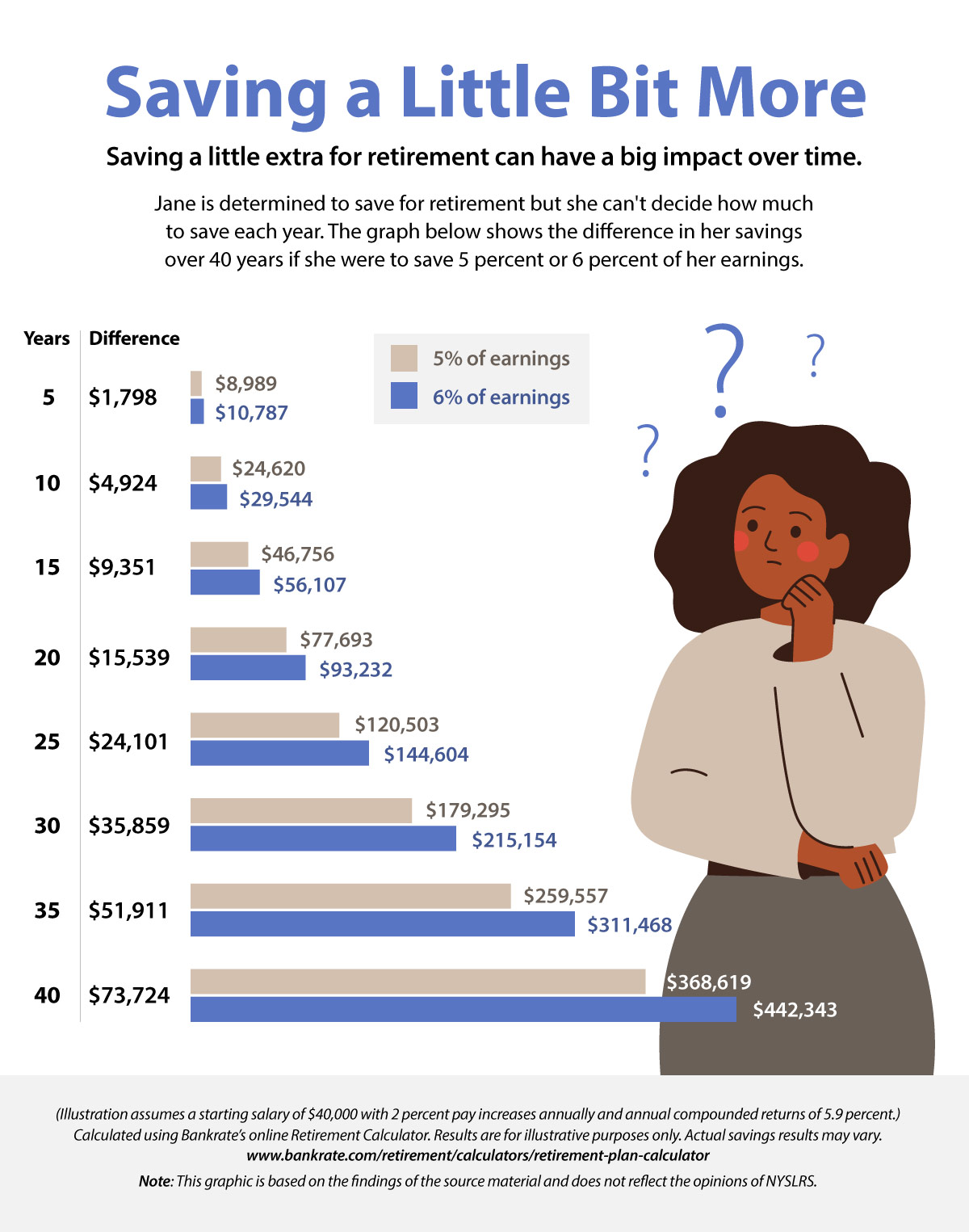

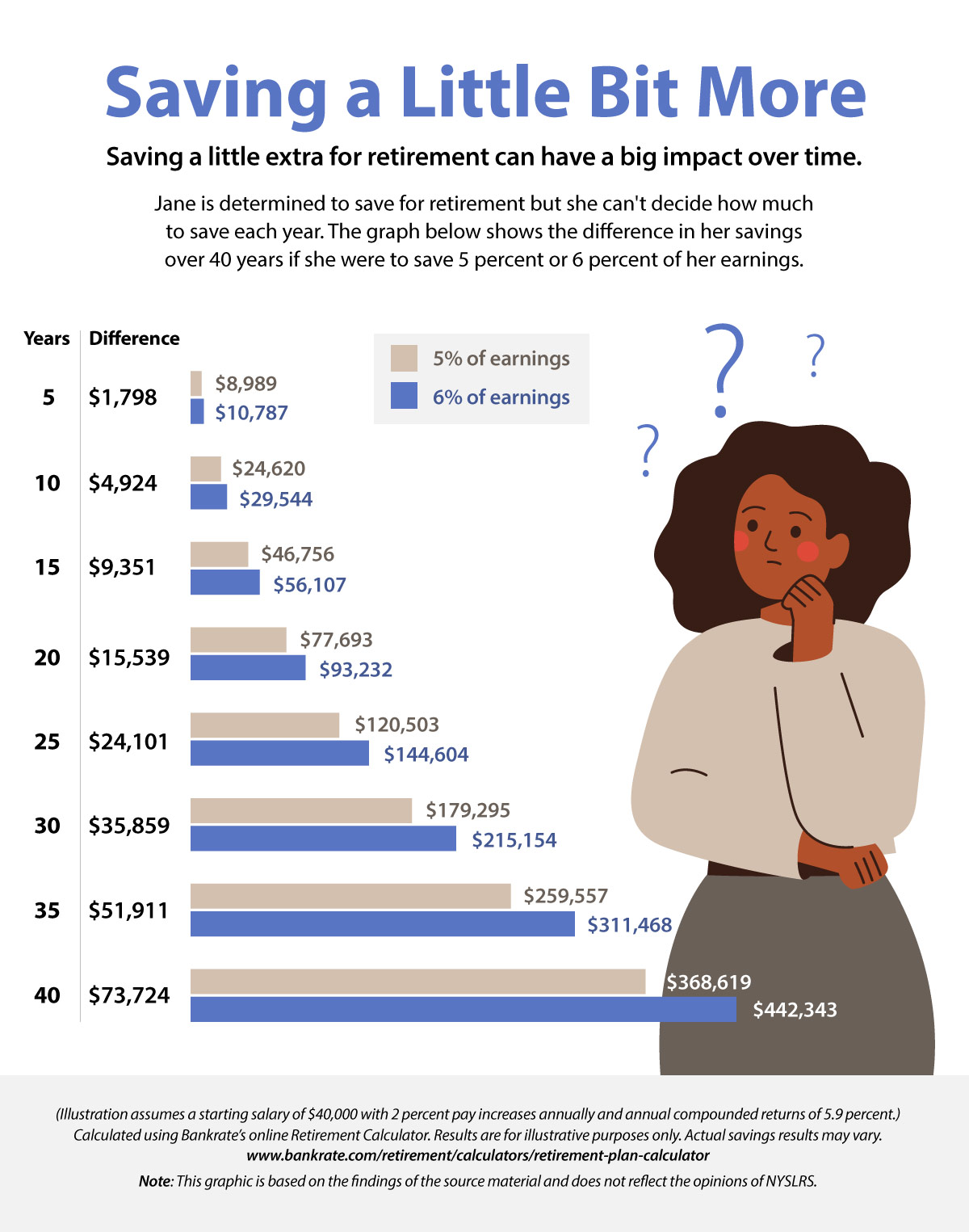

Give Your Retirement Savings A Boost New York Retirement News

How Do Deferred Compensation Plans Work Avier Wealth Advisors

Nonqualified Deferred Compensation Planner